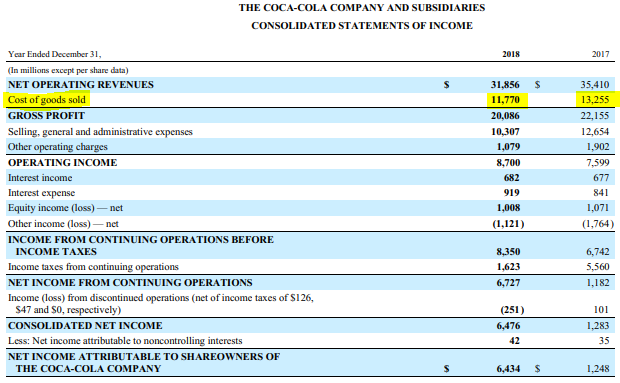

Any business cost directly related to the sale of your product or service becomes an expense once it’s been allocated to a sales transaction, even though it’s still referred to as a cost of goods sold.Īre you tracking your expenses and costs correctly?Įvery business has operating expenses, but whether or not those expenses can be classified as COGS depends on whether or not they’re directly related to the sale of a product or service. The $100 worth of widgets that you didn’t sell today, while still representing a cost to your business, won’t become an actual expense until they’re sold on some other day.ĭon’t get too hung up on the name. the remaining $100 constitutes an asset.įrom an accounting point of view, an expense is something that’s used up, or consumed, during the normal course of your business operations.$400 of that amount constitutes an expense and.If you spend $500 on today’s batch of widgets, but you only end up selling $400 worth of them: You have a pretty good idea of how many widgets you usually sell in a day, but you never want to risk a lost sale, so you always buy a few extras when you purchase your supplies each morning. Let’s say your company sells souvenir widgets to passing tourists from a truck on the street. The easiest way to illustrate the difference between these two terms is to look at a simple example. The terms "expense" and "cost" don’t always mean the same thing.Īn expense is a cost of doing business, but a cost is not necessarily always an expense.Understanding the difference between regular operating expenses and COGS begins with recognizing two important facts: In the case of a service industry, the term Cost of Sales (COS) is often used rather than Cost of Goods Sold since there are no physical goods involved, but for the purposes of this discussion, we’ll be using the generic term COGS. While both OE and COGS are considered expense accounts from a bookkeeping point of view, they’re separated on the income statement to differentiate between money that’s spent to keep your company running, and money that’s spent to directly support the costs associated with providing your company’s product or service. As one of the more common bookkeeping questions we hear, the difference between Operating Expenses (OE) and Cost of Goods Sold (COGS) is a fairly straightforward one, but it plays a significant role when it comes to allocating and analyzing the resources you spend to make your business profitable.

0 kommentar(er)

0 kommentar(er)